Inflation Trends and Fed Challenges

- Gaargi Bora

- Nov 28, 2024

- 1 min read

Inflation accelerated in October, according to the Federal Reserve’s preferred measure, the Personal Consumption Expenditures (PCE) index. The overall index rose 2.3% from a year earlier, up from 2.1% in September. Stripping out volatile food and energy costs, the core PCE index climbed 2.8%, slightly higher than the previous 2.7%. Monthly increases also held steady, with the overall index up 0.2% and the core up 0.3%.

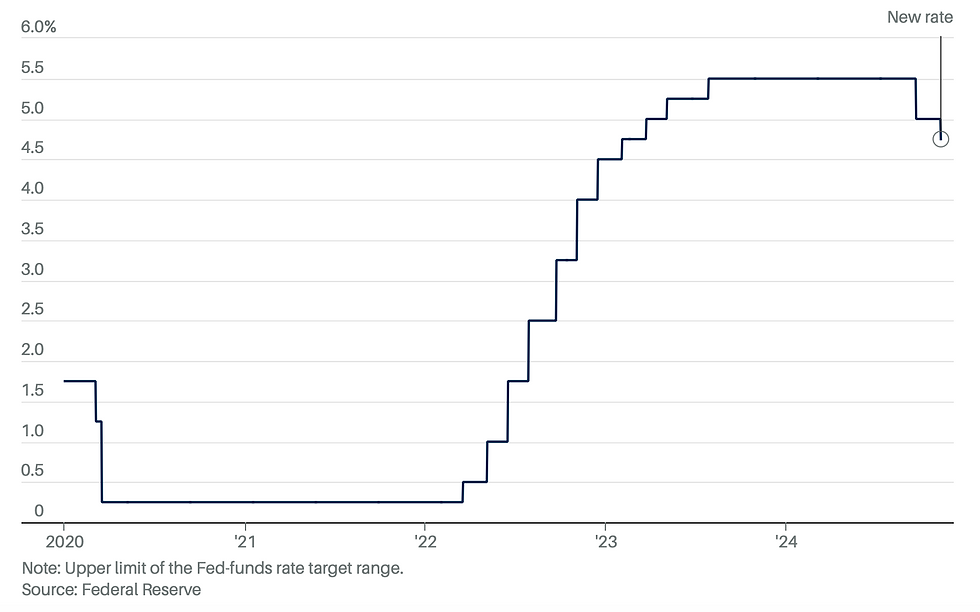

While inflation is far below its 2022 peak of 7%, it remains above the Fed’s 2% target. This “sticky” inflation complicates policymakers’ plans to ease interest rates. Previously, the Fed projected rate cuts starting in December and gradually lowering rates to 3.4% by 2025. However, investors now expect fewer cuts as officials reassess the outlook. Adding uncertainty is President-elect Donald Trump’s proposed tariff hikes, including levies on China, Canada, and Mexico. Economists predict these tariffs could push core inflation above 3% in 2025, delaying progress toward the Fed’s 2% goal.

Economic growth and consumer spending remain robust, with household incomes rising more than expected in October. Adjusted for inflation, spending climbed 0.1%, reflecting resilient demand. Analysts warn this strength could allow businesses to raise prices, sustaining inflationary pressures. Despite challenges, Fed Chair Jerome Powell remains cautious about reacting prematurely to policy changes. While growth driven by higher productivity and supply could ease inflation, tariffs and strong demand may force the Fed to maintain higher rates for longer.

Heading into 2025, central bankers face a balancing act: encouraging economic stability while containing inflation. As Fitch Ratings’ Olu Sonola noted, the Fed will likely remain “concerned and cautious.”

Comments