Federal Reserve Cuts Interest Rates Again

- Gaargi Bora

- Nov 10, 2024

- 1 min read

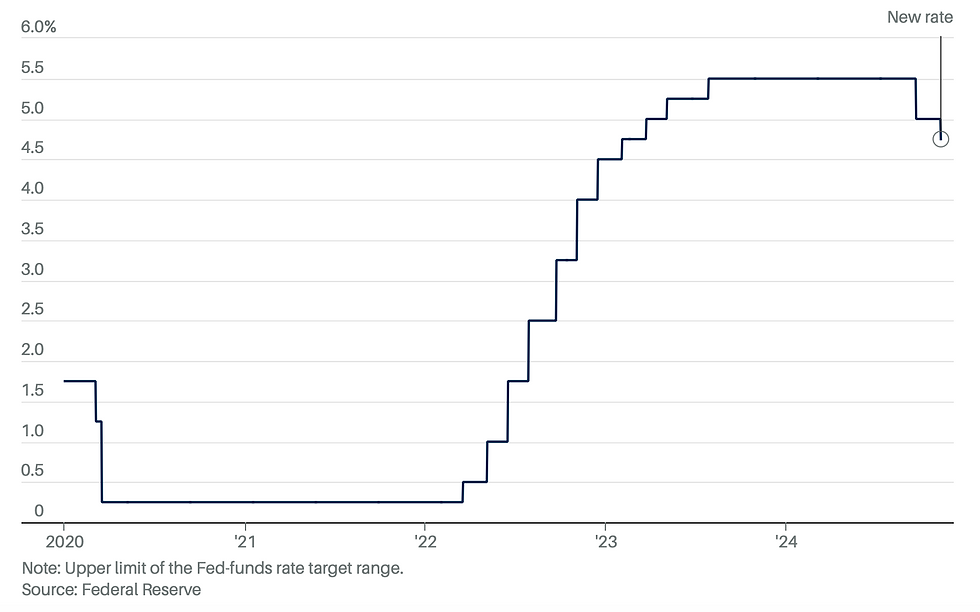

The Federal Reserve has announced a second consecutive interest rate cut, reducing its key borrowing rate by 0.25% to a range of 4.50%-4.75%. This follows a half-point cut in September and reflects the Fed’s efforts to adjust monetary policy amid ongoing inflation concerns and a cooling labor market. The move was expected by markets, and all Fed officials, including Governor Michelle Bowman, voted in favor.

This rate cut is seen as part of the Fed's recalibration to balance inflation control with economic growth. The central bank now views the risks to achieving both inflation and employment goals as balanced, indicating that while inflation is still a concern, the labor market is showing signs of softening.

Despite solid GDP growth and a still-strong labor market, the Fed continues to focus on reducing inflation, which remains above its 2% target. This rate cut could be followed by another in December, though the Fed is also carefully monitoring economic conditions and political developments under the new administration.

For consumers, this rate cut could impact borrowing costs, including mortgages, auto loans, and credit cards, though rates for these financial products have remained relatively high due to rising Treasury yields.

The Fed’s goal is to guide the economy toward a "soft landing," reducing inflation without triggering a recession.

Comments